The United States Internal Revenue Service Has Big Changes for Small Business Owners

Two-hundred-forty-seven pages later, we have one large Internal Revenue Service document — and a whole lot of questions about everything from qualified income to 199A QBI deductions.

Section 199A deductions are complex. What is a 199a QBI deduction? Do you fall into the 95% of taxpaying small business owners covered? When do IRC section 199A qualified business income deductions expire? What are the total taxable income ranges under the internal revenue code?

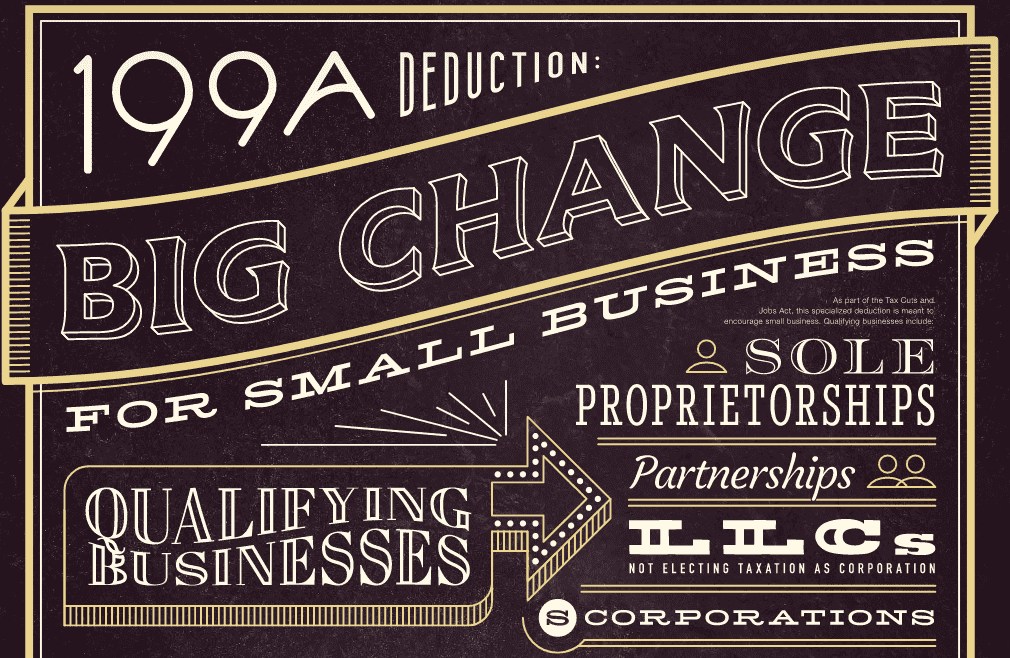

Learn more about 199A deductions and how you might be affected in the following infographic. Need additional help? Get matched with one of our financial advisors or speak directly to a tax professional.