Special Update

A second COVID-19 vaccine announced very positive results in its initial trial. A biotechnology company announced Monday their COVID-19 vaccine was more than 94.5% effective.

The study also showed there were few side effects observed in the vaccine trial. The effectiveness is very high and will likely give the world two vaccines to start protecting people in coming months.

The news boosted markets at the time of writing, although a quicker end to the virus may hurt the short-term prospects of companies whose products have seen increased use during the pandemic. This is welcome news during a period where many parts of the country are facing severe COVID-19 outbreaks. Stay safe.

A drug company announcement that its vaccine had proven very effective in preventing COVID-19 provided a boost of additional optimism to an already strong market. The results were welcome good news as the U.S. is facing record numbers of new cases and increasing hospitalizations. Governments and individuals are expected to curtail activity as part of the effort to fight the virus.

Key Points for the Week

- Increases in COVID-19 cases will likely cause reduced activity, pressuring the economic recovery in coming months.

- Inflation dropped for the third consecutive month and has only increased 1.2% in the last year.

- With the likely approval of an effective vaccine, value stocks rallied on expectations of a future economic reopening.

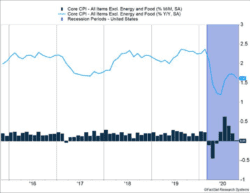

Initial unemployment claims continue to trend lower, dropping to 709,000 last week. Inflation remains well controlled. The Consumer Price Index has risen just 1.2% over the last 12 months. Core inflation, which excludes food and energy, was basically unchanged [Figure 1] and reflects weak underlying price pressures. Medical costs, shelter, and tuition saw a slower rate of price increases or outright price declines.

The S&P 500 jumped 2.2% last week, and global stocks, represented by the MSCI ACWI Index, climbed 2.3%. The Bloomberg BarCap U.S. Aggregate Bond Index slid 0.1%. The S&P 500 is now up 12.8% in 2020. Value stocks benefited from the news of a vaccine helping companies with less emphasis on technology. The Russell 1000 Value gained 5.7% last week while the Russell 1000 Growth dropped 1.3%. For the full year, the Russell 1000 Growth has outgained the Russell 1000 Value by more than 30%.

This week’s news could include test results from a vaccine developed by another reputable biotechnology company. The U.S. and China will report retail sales and industrial production numbers, providing a comparison of how two countries with very different COVID-19 case counts are faring.

Figure 1

Moving Toward a New Era

The post-COVID era has become imaginable at the same time some Thanksgiving guest lists are shrinking. One pharmaceutical company announced its vaccine, developed with its biotechnology partner, was more than 90% effective in initial trials. They plan to produce 50 million doses in 2020 and 1.3 billion doses in 2021. Each person requires two doses, which are spaced 21 days apart.

At the same time, much of the U.S. and Europe are facing the severest outbreak in new COVID-19 cases to date. The sharp spike has caused individuals to reassess their activities and for governments to increase the strictness of social distancing measures. Schools are adjusting schedules and taking additional precautions. Some families are cutting guest lists or cancelling Thanksgiving Day dinners to reduce their risks of contracting the virus.

The combined changes put the economy in a situation where the intermediate future has begun to brighten at the same time the near-term is getting bleaker. The restrictions aren’t expected to be as tight as they were previously. Government actions restricting economic activity will generally remain looser than during the March-April period if hospitals are able to cope with the number of patients. Individuals are likely to restrict their own activity as the hope of a vaccine provides incentives to put off to next year what could be done today.

Market reaction to the news of a successful vaccine trial pushed stocks associated with reopening higher. The Russell 1000 Value Index outpaced the Russell 1000 Growth Index by 7% last week. Value stocks are generally more reliant on physical connection and less reliant on technology than growth stocks. Value has underperformed growth by more than 30% this year as investors have favored companies better able to serve customers without physical interactions.

Economic data last week confirmed the economy is recovering, but the recovery remains precarious. Initial jobless claims inched down to 709,000, and continuing claims dropped below 7 million. Yet, the use of programs for self-employed workers and those who have used up their initial unemployment benefits are at high levels. Core inflation, which excludes food and energy, barely increased last month after rising more than 0.5% four months ago.

The toughest near-term challenge is to keep the recovery going while reducing the number of daily new cases. The first focus will be to distribute the vaccine. Additional government aid to people out of work as well as the potential for direct checks to individuals will provide funds for spending as well as paying bills and debts to avoid additional economic damage. Key industries, such as airlines and schools, are also expected to get additional support.

The increase in cases will shift what data is most important in coming weeks. Economic reports will still be important but probably won’t carry as much weight as additional vaccine results. Health officials face some interesting questions based on data from new trials. What if new vaccines are easier to administer but less effective? How should doses produced be distributed around the world? Who should get the initial doses? Every effective vaccine means more people reduce the risk of contracting the virus and passing it on to others. For vaccines this Thanksgiving, the more the merrier.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.wsj.com/articles/weekly-jobless-claims-coronavirus-11-12-2020-11605125188

https://www.kshb.com/news/local-news/independence-schools-extend-thanksgiving-break

Compliance Case: 00875093